From a tax point of view, an individual is considered to be a tax resident in Spain if he meets any of these three requirements:

The 183-day rule

One way to become tax resident in Spain is to stay more than 183 days in Spanish territory during the year. Sporadic absences are included in order to determine permanence in Spanish territory, unless the taxpayer proves his tax residence in another country by means of a certificate of tax residence.

The rule of the center of economic interests

Another way of becoming tax resident in Spain is for the taxpayer to have in Spain the main nucleus or base of his activities or economic interests, directly or indirectly.

The centre of vital interests rule

The last way to become tax resident in Spain consists of having your non-legally separated spouse and/or dependent underage children residing in Spain.

Once it has been determined that the individual is a tax resident in Spain, these three taxes must be taken into account:

- Income Tax Return

- Wealth Tax

- Form 720 – Declaration of assets abroad.

Income Tax Return

All income earned worldwide will be included, that is, you will have to declare your salary from both Spain and other countries, as well as income from property located abroad. The tax rates for earned income are as follows:

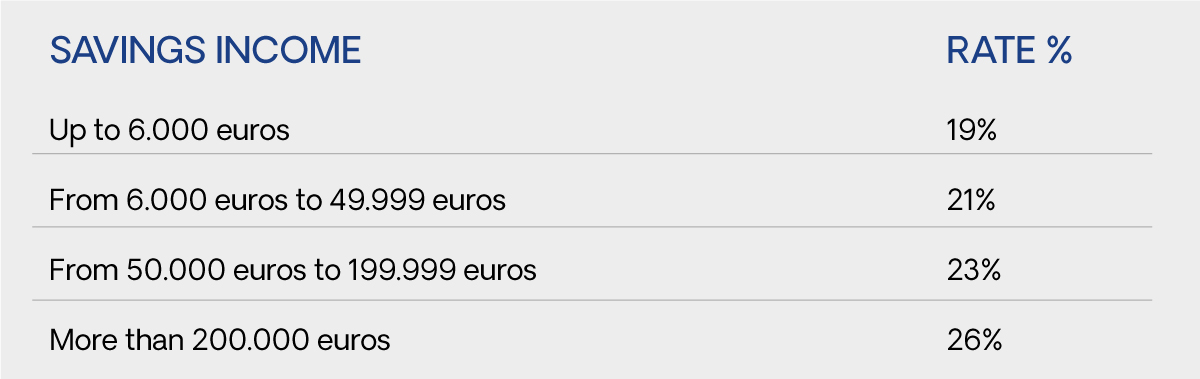

Dividends you obtain from other companies must also be taxed in Spain. The tax rates for savings income are as follows:

It should be borne in mind that in both cases the double taxation agreement between Spain and the corresponding country can be applied to partially or totally deduct the tax withheld, if applicable.

In the event that you had to travel to another country to carry out your work, we could consider the application of article 7p of the Personal Income Tax Law, which regulates the exemption of income for work effectively carried out abroad, up to a limit of 60.100€. This is a tax benefit whose application requires the following requirements to be met:

- 1st – That such work is carried out for a company or entity not resident in Spain or a permanent establishment located abroad.

- 2nd – That in the territory in which the work is carried out a tax of an identical or analogous nature to personal income tax is applied and it is not a country or territory considered to be a tax haven. This requirement will be fulfilled if the country or territory in which the work is carried out has signed an agreement with Spain to avoid double international taxation that contains an information exchange clause.

Deadline for submission: Between April 1 and June 30 of the following year.

Wealth Tax

You will have to file a Wealth Tax return (individuals by personal or real obligation) if you are in any of these situations:

- Your tax liability, determined in accordance with the rules governing this tax, and after applying the appropriate deductions or allowances, is payable.

For the purposes of applying the first limit, bear in mind that if the taxable base, determined in accordance with the tax regulations, is equal to or less than the exempt minimum established, either in general at 700.000€, or in the amount that the Autonomous Communities have approved for their residents in the exercise of their regulatory powers over the aforementioned exempt minimum, there will be no obligation to file a tax return.

- When, in the absence of the aforementioned circumstances, the value of your assets or rights, determined in accordance with the tax regulations, is greater than 2.000.000€.

For the purposes of applying this second limit, you must include all the assets and rights you own, whether or not they are exempt from tax, without taking into account any charges or encumbrances that reduce their value, or any personal debts or obligations for which the owner of the assets or rights is liable.

In the case of autonomous communities, such as Andalusia, this tax has been abolished as of 2023.

Deadline for submission: Same as the Income Tax Return, between April 1 and June 30 of the following year.

Form 720 – Information return on assets located abroad

The obligation to file Form 720 falls on those holders, representatives, authorised persons, beneficiaries, persons or entities with powers of disposal or beneficial owners, to report on accounts in financial institutions located abroad. To this, it is also necessary to add the obligation to report on securities, rights, income and insurance obtained outside the national territory, as well as real estate/rights over real estate located there.

This obligation is limited by an amount: there is no such obligation if the asset or the sum of assets does not exceed 50.000€. On the other hand, focusing on accounts in financial institutions, filing will also be obligatory if the sum of the balances on 31st December or the average balances of the last quarter exceeds this figure.

Once this tax has been filed, it will be obligatory to file for the following years only if the average balance has increased by more than 20.000€, taking as a reference the last tax return filed.

Deadline for submission: From January 1 to March 31 of the following year.

If you are in need of legal services on the Costa del Sol, do not hesitate to contact Franke & De la Fuente for an initial free consultation.